What Is XRT ETF?

XRT is the ticker for the SPDR S&P Retail ETF, a specialized fund engineered to match the S&P Retail Select Industry Index. Imagine a dynamic shopping cart brimming with shares from America’s most visible brick‑and‑mortar giants and nimble e‑commerce disruptors — all wrapped into one exchange‑traded fund. Since its launch in October 2006, XRT has provided investors with an accessible, single‑ticket way to track retail’s broad evolution, from suburban malls to mobile wallets.

Key Takeaways

-

Diversification at Work: Roughly 100 retail‑sector names, each equally weighted, mitigate concentration risk.

-

Balanced Exposure: Established staples like Walmart and Target sit side‑by‑side with growth racers such as Etsy and Ulta Beauty.

-

Seasonal Sensitivity: Retail calendars — from Black Friday to back‑to‑school — drive rhythm in performance.

-

Turnover and Rebalances: Quarterly index reviews ensure emerging retailers can enter the mix, while underperformers exit.

-

Tax Efficiency: As an in‑kind creation/redemption ETF, XRT tends to distribute fewer capital gains than comparable mutual funds.

Composition And Methodology

Underlying Index

The S&P Retail Select Industry Index, crafted by S&P Dow Jones Indices, underpins XRT’s structure. Only companies deriving at least 50% of revenues from retail sales qualify, spanning subsectors from grocery and home improvement to sporting goods and specialty boutiques. The index is reconstituted quarterly, with buffer rules that help smooth turnover: only stocks moving beyond the 25th–75th percentile band rotate in or out.

Weighting Criteria

XRT’s equal‑weight model assigns each constituent an identical starting weight at rebalance — typically around 1% apiece. This contrasts starkly with market‑cap approaches, where behemoths like Amazon and Walmart can dominate 15–20% of a fund’s assets. Equal weighting allows smaller, fast‑growing retailers to exert meaningful influence on fund returns, while capping any single stock’s drawdown impact.

Retail Sector Exposure Analysis

Top Holdings And Weightings

As of mid‑2025, XRT’s top names include Macy’s, Dollar Tree, and The Cheesecake Factory — each at roughly 1.1%. Meanwhile, mid‑ and small‑caps such as Five Below and Capri Holdings hold equivalent stakes. This democratic weighting fosters a “rising tide” effect: when consumer sentiment improves, a broad swath of retailers can benefit, not just the large‑cap titans.

Subsector Breakdown

-

Department & Discount Stores (25%): Macy’s, Kohl’s, Dollar Tree

-

Specialty Retailers (30%): Ulta Beauty, Foot Locker, GameStop

-

Online‑Only Retailers (15%): Etsy, Chewy, Wayfair

-

Home Improvement & Auto Parts (20%): O’Reilly Automotive, Home Depot

-

Other (10%): Pet supplies, restaurants, sporting goods

This subsector mix allows XRT to capture both cyclical plays (auto parts, home improvements) and defensive niches (discount stores, essential goods).

Performance Metrics And Trends

Historical Returns

Since inception, XRT has averaged about 8.8% annualized returns (through June 2025), marginally trailing the S&P 500’s ~10% but outpacing many single‑sector peers. In bull markets, the equal‑weight model often delivers “small‑cap-like” upside, while in downturns, losses may be more pronounced. Seasonal peaks typically occur in Q4 holiday cycles and early Q2 spring buying seasons.

Volatility And Risk Measures

With a standard deviation near 16 percent as opposed to the 14 percent of the S&P 500, XRT is moderately volatile. Maximum drawdowns have ranged between -25 and -35 percent during recessionary periods, confirming the cyclical nature of retail. Sharpe Ratio of about 0.6 would suggest the risk-return tradeoff to be fair for investors looking toward sector-specific exposure.

Trading And Liquidity

Bid-Ask Spreads And Volume

XRT’s average volume of three-and-a-half million shares a day with a bid-ask spread of less than 3 cents provides efficient order execution even for larger positions. Institutional traders enjoy the deep liquidity of the ETF both during U.S. and global trading hours with authorized participants ensuring smooth creation/redemption cycles to limit premium/discount swings.

Many investors access XRT through standard brokerages and trading platforms — and where supported by the broker, advanced terminals such as MetaTrader 5 (MT5) or an MT5 trading app provide real-time charts and order tools that some active traders find useful.

Expense Ratio And Costs

XRT’s annual fees of 0.35% rank above those of plain vanilla broad-market ETFs (often below 0.05%) but for specialized equal-weight sector funds are quite competitive. A $50,000 position pays $175 yearly in fees, which investors must consider alongside the benefits of specific retail exposure and active rebalancing.

Strategic Uses Of XRT

Income And Growth Strategies

-

Dividend Reinvestment: Many holdings pay modest dividends (average yield ~1.4%). Reinvesting these can compound returns over time.

-

Small‑Cap Growth Tilt: XRT’s equal‑weight structure amplifies the impact of high‑growth, smaller retailers, making it a hybrid tool for income plus growth seekers.

Tactical Allocation

-

Seasonal Timing: Scale positions ahead of key shopping events—Black Friday, Cyber Monday, Prime Day — to capture pre‑event run‑ups.

-

Sentiment Signals: Overlay Conference Board consumer confidence and retail sales data to adjust exposure dynamically.

-

Pair Trades: Hedge XRT with inverse consumer staples or utilities ETFs to neutralize broad market risk while staying sector‑focused.

Risks And Considerations

Sector Concentration Risk

XRT concentrates on the retail sector with no defensive-sector protection. Shock events — pandemic lockdowns, sudden tariff impositions, or shopping mall bankruptcy proceedings — could weigh disproportionately on performance. Always consider signifying alt position size in a diversified portfolio.

Market Cycle Sensitivity

Retail, generally, leads during recession and lags behind during recovery. In times of turmoil, first on the block in terms of tightening discretionary spending, it draws XRT further down before it glides down broader index lanes. Early in expansions, on the other hand, a retail rebound can be very sharp and provide timely upside.

Alternative ETFs And Benchmarks

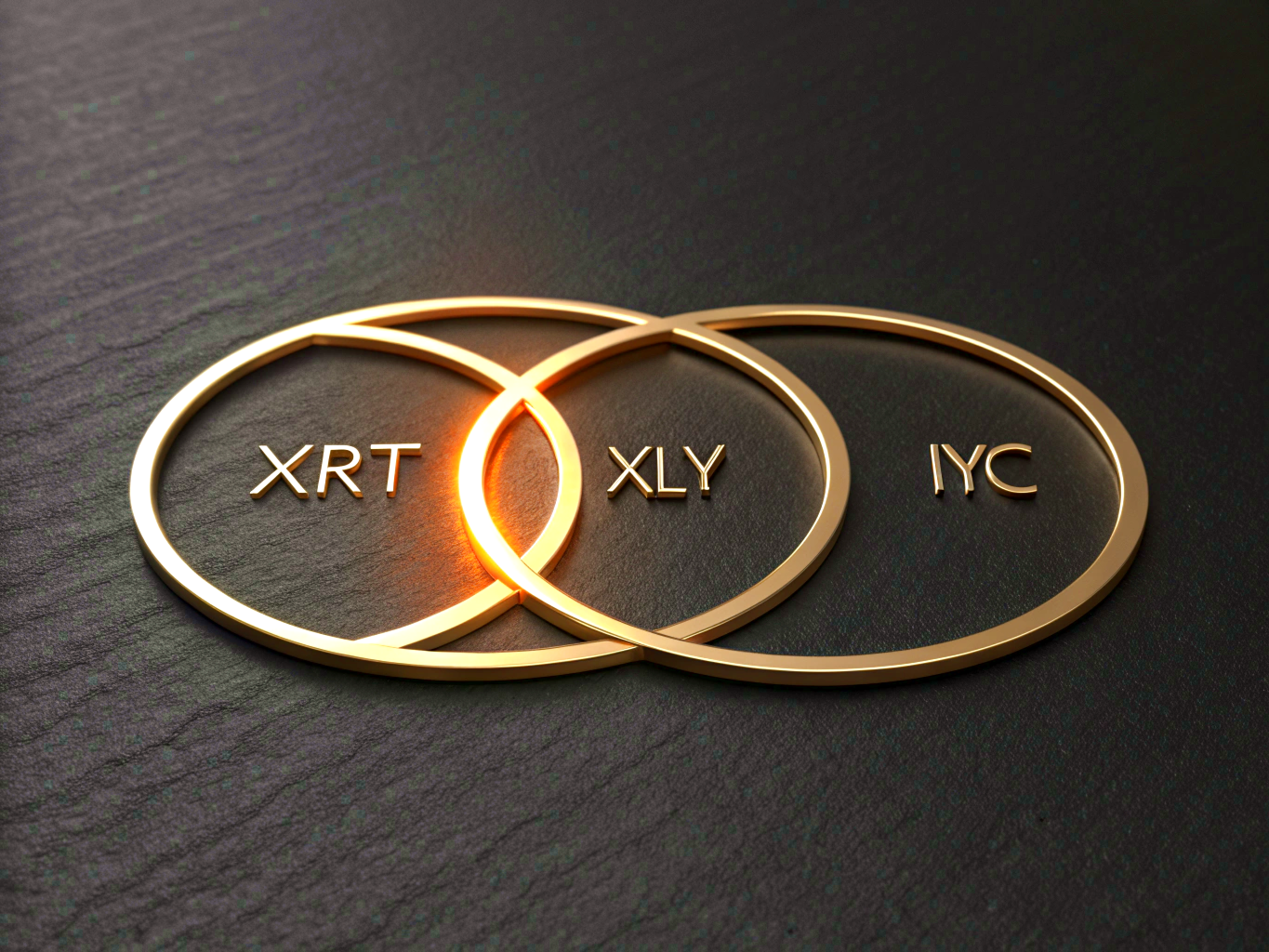

SPDR S&P Retail ETF (XLY)

XLY mirrors the same retail index but uses market‑cap weighting. Giants like Amazon (~20%) dominate, providing smoother rides in downturns but ceding some upside potential in rebounds.

iShares U.S. Consumer Services ETF (IYC)

IYC extends beyond retail into travel, leisure, and entertainment, offering broader consumer‑services exposure. Useful for investors seeking retail plus experiential spending themes.

Frequently Asked Questions

What Does XRT Stand For?

XRT is the ticker symbol for the SPDR S&P Retail ETF, designed to track the S&P Retail Select Industry Index.

How Can Investors Buy XRT?

Simply place a buy order for “XRT” through any standard brokerage account during market hours. Settlement follows T+2 protocols.

Is XRT Suitable For Long‑Term Investments?

Yes — as part of a diversified allocation, XRT can deliver both income and growth potential over full market cycles, though investors must tolerate retail’s cyclical swings.

How Does XRT Compare To Other Retail ETFs?

XRT’s equal‑weight design gives smaller retailers a louder voice compared to cap‑weighted peers (like XLY), potentially boosting returns in uptrends but also increasing volatility.